How To Find The Best Stocks For The Wheel Strategy 2023

The wheel strategy is a very popular strategy that is used when trading options. I am going to show you how to do it and how to find stocks that are good for this strategy.

What Is The Wheel Strategy

The Wheel Strategy involves selling premium. What you do is sell a put option on a stock you want to own with the intention of collecting premium and not having to take ownership of the stock. If however the stock does fall past the strike price of your put option and you have to take assignment of the stock you can then sell call options against the position.

How To Do It

Here is a simple example of what happens when a stock falls below the strike price of the put option you sold.

- Sell 1 put option on apple with a strike of $150 with the intention that the price stays above $150 and collect premium

- If the price falls below $150 and you are forced to take ownership of 100 shares of Apple Stock

- You then sell 1 call option on apple at $150 and collect premium

- The price rises above $150 and your 100 shares of apple stock are called away

If the price stays below $150 you can sell another call option collecting more premium until eventually the stock is called away.

This is a very simple example, you will need to adjust the strike price and expirations accordingly.

To learn more about the wheel strategy read the full guide on What Is The Wheel Strategy And How To Use It.

What Stocks To Look For When Selling Options

You need to choose the rights stocks for this strategy. To find them you want to look for stocks that are in the upper range of their IV percentile because premiums for selling options will be higher while also maintaining a balance between being to risky of a stock. It should be a stock you are comfortable owning. You can screen for stocks on the platform you are using. I will show you how to on Thinkorswim.

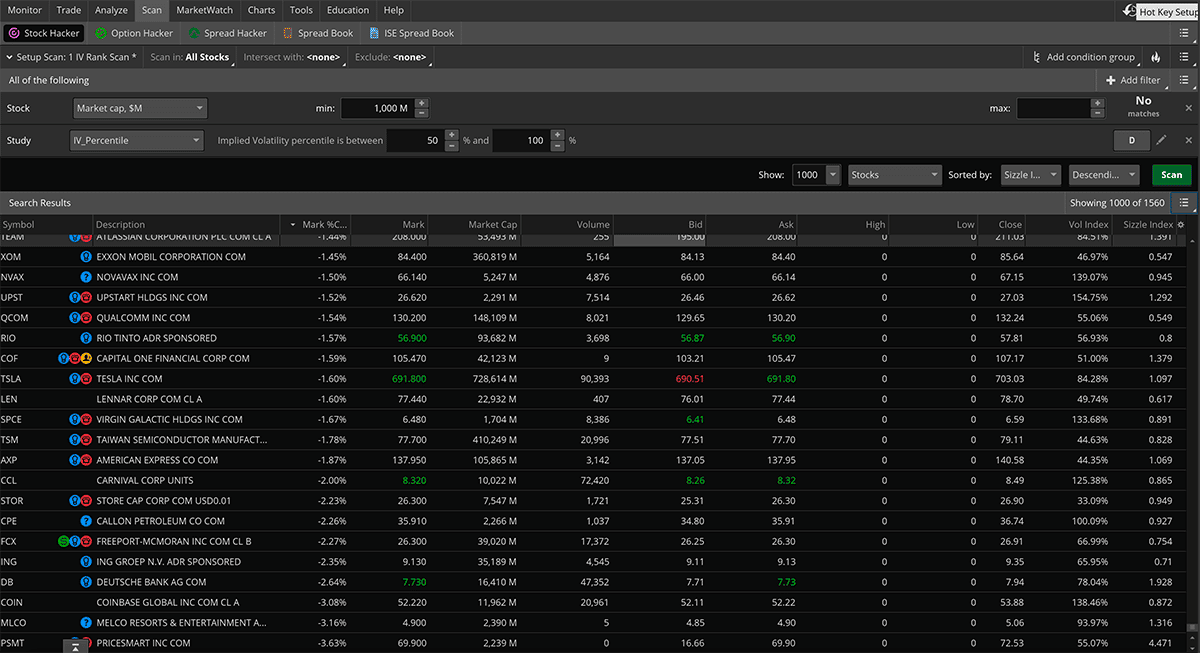

Scanning For Stocks

Go to the scan tab on Thinkorswim and click add filter and then choose iv_percentile and set the implied volatility between 50% and 100%. This will show you stocks that are in their higher percentile of volatility compared to their past volatility. Below is a screenshot of what it will look like. You can see a list of all stocks that fit this criteria.

You want to go through these stocks that you have scanned and make a watchlist of the ones that you would see yourself wanting to buy. Keep in mind that not all of these will be worth selling options on because the premiums still may not be high enough to make the trade worth pursuing. So you will have to narrow your watchlist down even further by looking at the price of the options contracts to see if there is enough value there for the stocks you have chosen.

Probability Of Expiring Out Of The Money

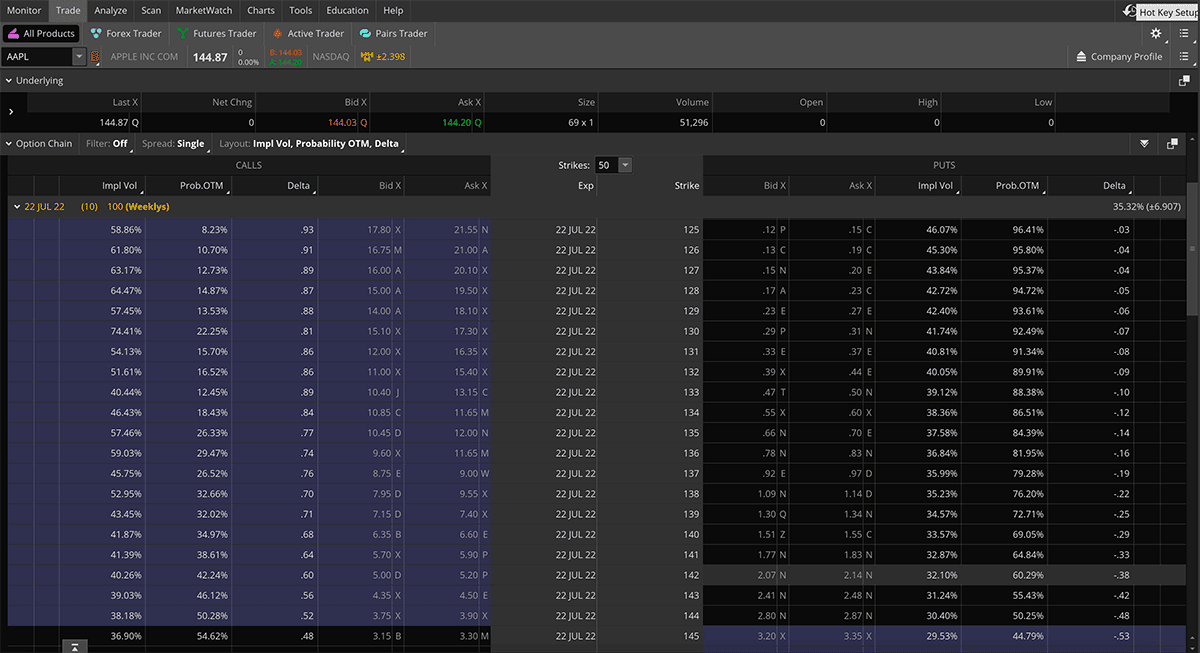

Another thing to look out for after you have chosen a stock is that the option contracts you choose to sell have at least a 70% chance of probability of expiring out of the money. There is a column on most platforms that will show this if you go into the settings and add it. Here is what it looks like on Thinkorswim you can see the column called Prob OTM in the image below showing you the percentage of probability that it will expire out of the money based on past volatility.

Conclusion

2023 can be a great time to use this strategy because many stocks are already down a huge percentage which makes your risk much less than if stocks were at all-time highs. When using the Wheel Strategy you need to manage your risk and have a plan for when things go wrong that is the key to making this strategy work because losses can quickly erase your gains if you are not paying attention.

For more on the Wheel Strategy check out How Profitable Is The Options Wheel Strategy.