How Profitable Is The Options Wheel Strategy

The options wheel strategy can be a great way to generate consistent passive income. With any strategy, you need to have realistic expectations. Selling put options consistently on stocks you want to own can be much less risky than just buying the stock outright. The annual average return on the S&P 500 is 9.87% but this is far from steady income because the stock market can move down for many months or years at a time before rising again.

Why Use The Wheel Strategy

Using options you can generate more consistent returns on a monthly or weekly basis without the huge drawdowns in your portfolio. Option wheel strategy returns can have a very high win rate but without proper risk management one loss can wipe out months of your profits in one trade.

Expected Returns

Let's look at a potential trade to see how much we can expect to return and how much risk we are taking. First, you need to find a stock to sell either call or put options on. You can find out which stocks to choose by reading this post How To Find Stocks For The Wheel Strategy.

Implied Volatility

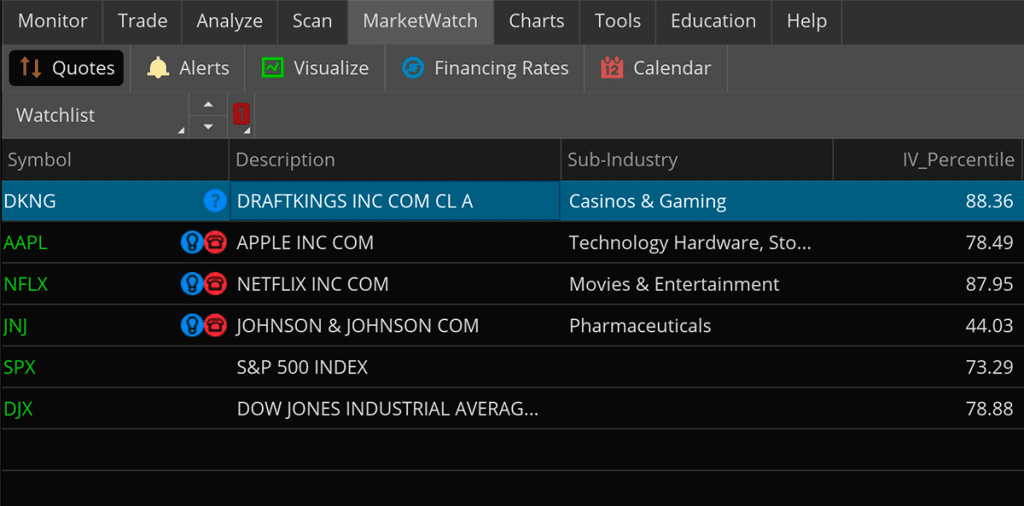

You can see DraftKings (DKNG) has a high implied volatility percentile of 88.36 which meets the qualifications we are looking for. If you want to know more about IV Percentile check this out.

Risk

DraftKings has a current market price of 13.22 and for a put option with an 11.5 strike price is selling for $18. That gives us a break-even point of 11.50 which is 13% below the current price. Meaning in 1 week the stock has to drop 13% before you will lose money.

Profits

So if we were to sell 6 put options that means we would collect a premium of $108 on a value of $7,932 of stock in DraftKings. This is a 1.3% return in just one week. This may not seem like a lot but that is 5.2% a month or a 62% annual return.

Conclusion

While this is a very popular investing strategy you are very likely not going to get a 62% return because you are going to have drawdowns and have to sell call options against the position or cut your losses. But if you manage your risk you can generate consistent returns using the options wheel strategy.