How To Use The Price Channel Trading Strategy - Full Guide

The Price Channel Trading Strategy is used by identifying and trading the upper and lower limits of a stock's price. To use this strategy you want to take advantage of a stock's tendency to remain within a certain range over time by buying at the bottom of the channel and selling at the top.

What Is a Price Channel

A price channel is created when a stock's price oscillates between two parallel lines. These lines are trend lines that are drawn along the peaks and valleys of the stock's price, or they can be horizontal lines that mark the stock's support and resistance levels. A stock's price channel is the range of prices at which it trades over a given period of time. The upper and lower limits of this range are determined by the stock's support and resistance levels. A stock's price will tend to move between these levels, bouncing off of them when it reaches one extreme or the other.

Different Types of Price Channels

There are three main types of price channels: ascending, descending, and horizontal. Understanding these different types of price channels is important because it will help you decide which direction you should place your trades in.

Ascending

An ascending price channel or otherwise known as a bullish channel forms when the price of a stock is contained within an upward-sloping trendline, with higher lows and higher highs. This type of channel indicates that the asset is in an uptrend and that prices are likely to continue to rise. As long as the prices stay in this channel it can be a sign that the stock is bullish.

Descending

A descending price channel or known as a bearish channel forms when the price of a stock is contained within a downward-sloping trendline, with lower highs and lower lows. This type of channel indicates that the asset is in a downtrend and that prices are likely to continue to fall. Until the stock breaks up and out of the channel this is seen as a bearish trend.

Horizontal

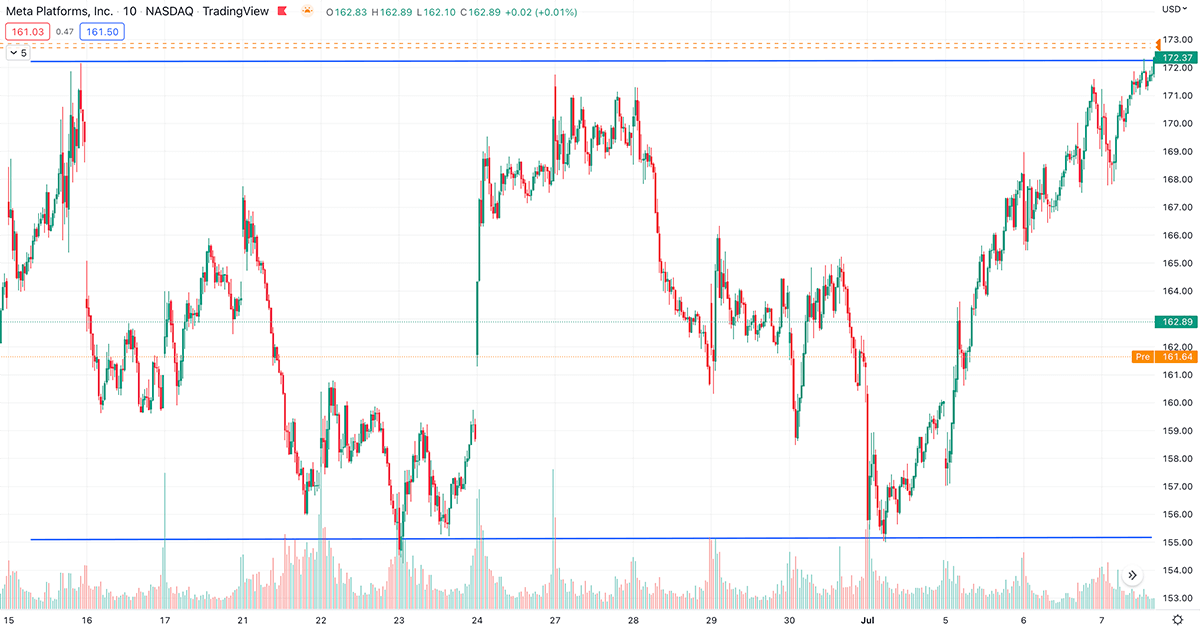

A horizontal price channel forms when the price of the stock moves back and forth between two parallel levels. This type of channel indicates that the asset is range-bound and that prices are likely to continue to fluctuate between the two levels until it breaks out of the channel. When using this channel this can be known as trading the range.

How To Find Price Channels

Finding price channels on a chart is very easy, you simply first need to identify which way the trend is currently moving. Is the stock moving up, down or is range bound? Then if you see what appears to be a channel try to draw trend lines that connect a series of highs or lows. These lines should run parallel to each other to form a channel.

Ways to Trade Price Channels

How To Trade Ascending Price Channels

When trading an ascending price channel, it is important to watch for the price to break out of the channel. A breakout can occur in either direction, but the more profitable opportunities typically occur when the price breaks out to the upside. When trading a breakout, it is important to place your stop loss just below the support level that has been broken. This will ensure that you are taken out of your trade if the breakout turns out to be false. You can also trade the support line of the channel as well anticipating that the price will bounce and continue back up to the top of the channel.

How To Trade Descending Price Channels

When a descending price channel forms, you will want to watch for a breakout below support or a bounce off resistance. A breakout below support would signal potential further downside while a bounce off resistance could lead to a potential upside move. When trading descending price channels, you want to look to enter short positions near resistance and take profits near support. If the descending price channel is part of a larger downtrend, you may also decide whether you want to add to your position on a breakout below support. For your stop losses they can be placed either above resistance or below support depending on which way you are expecting prices to move.

How To Trade Horizontal Price Channels

With horizontal channels, you can trade both the upper and the lower parts of the channel since it is range bound and there is no general trend making higher highs and lower lows. You will be looking for a bounce off of the upper and lower lines anticipating that it will stay inside the channel. Place your stop loss outside of the channel because you will know when the pattern is broken in when the price breaks the upper or lower line. You can also trade upper and lower breakouts of this channel as well placing trades when it breaks.

Should You Use this Strategy

This can be a great rule based strategy because know exactly when to exit and enter a stock because based on the lines of the channel you have drawn so there is no guessing. Many platforms even have indicators that will automatically draw channels for you. Another useful thing about this strategy is you can trade it in any type of market conditions as well. For more see this article 3 Types Of Daytrading Strategies.