How To Correctly Identify Market Conditions When Day Trading

One of the biggest things to know when day trading is how to identify market conditions. This can play a huge role in how well your strategy works. You can have a profitable strategy but if you trade it at the wrong times it will likely not work.

Types Of Market Conditions

There are two major types of market conditions you need to understand. If you have a strategy that works very well in a trending market but we happen to be in a range bound market you will likely encounter many losing trades that will make you think your strategy doesn't work. This isn't the case because your strategy likely didn't stop working, the market just changed. The market can stay in a trending or a range bound market for many months at a time. So if you are choosing a stock to trade make sure that it is in the correct market condition for your strategy.

Trending Market

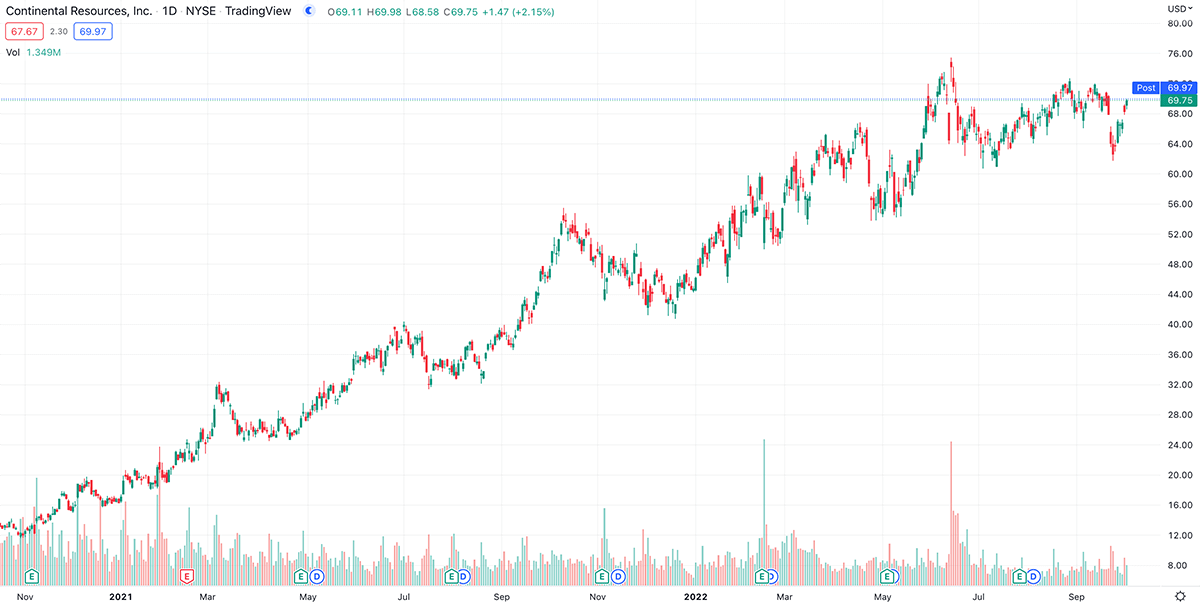

A trending market is exactly what it sounds like, it is a market that is steadily moving in one direction that can be either up trending market or a down trending market. A trending market will have small pullbacks before continuing in the direction that it is moving in making higher highs or lower lows. These trends can last many months or years. So you may have been successfully trading your favorite stock for 2 years but then suddenly your strategy stopped working. The stock likely isn't trending anymore. So you need to move on to a stock that is trending. There can be weak trends and strong trends so you want to also be looking to make sure the trend is strong and not going to break. If your strategy involves only shorting then you will only be looking for down trending markets and if your strategy involves going long then you will be looking for up trending markets. Your strategy could also combine both up trending and down trending but you would want to avoid ranging markets.

This is an up trending market on Continental Resources (CLR)

Range Bound Market

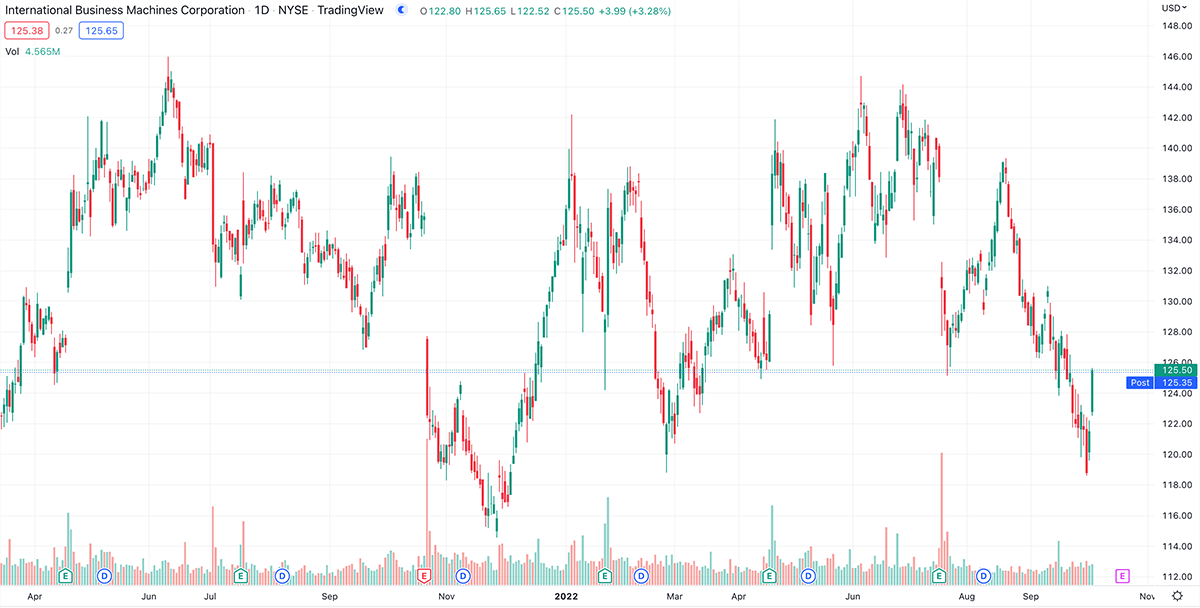

A range bound market is when the market is moving in a range. It is not making new highs or lows. It is just bouncing back and forth in a channel. Some strategies work very well in these types of market conditions. It can also be very easy to know when the market is no longer in a range bound market because as soon as a stock breaks out of the channel you know that it is currently no longer worth trading with your strategy. Stocks can also stay range bound for many months or years before changing.

This is a range bound market that (IBM) is currently in.

Conclusion

Knowing the difference between the type of markets is important. You need to have patience and know when to trade and when not to trade because that is equally as important as your strategy.